When Courage Wins

"Asymmetric Opportunities" in decision-making

A few days ago, I came across an intriguing concept that I’d like to introduce to you: asymmetric opportunities. Simply put, these are opportunities or choices that offer more potential benefits than losses. We often believe the adage "high risk, high return" to be an absolute truth—that achieving significant results requires taking proportional risks.

However, reality doesn't always align with this notion.

Asymmetric Opportunities

The term asymmetric returns (opportunities) originally comes from finance. When we think of investment products, stocks are usually the first thing that comes to mind. However, the investment world is vast, has a variety of products, including derivatives. My knowledge in finance is limited to a couple of classes I took in school, so I’ll stop pretending to be an expert here.

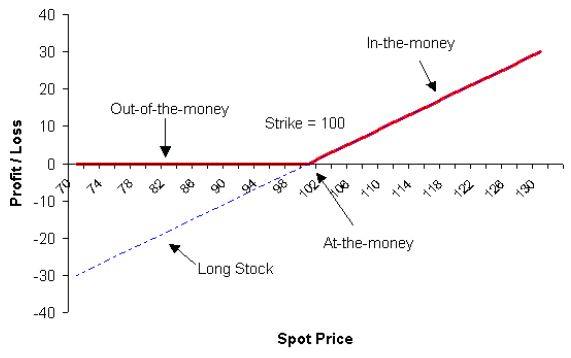

In simple terms, these are financial instruments designed to cap potential losses while maximizing possible gains. (Refer to the chart below)

What’s fascinating is that this concept exists not just in finance but also in our everyday lives. In other words, we can often find opportunities where the potential gains far exceed the losses in out lives. This idea gained significant traction when James Clear, the author of Atomic Habits, mentioned it on Twitter in 2018, which went viral.

James Clear cited examples like writing a book, investing in startups, and stock investing as asymmetric opportunities. Do you agree?

Later, the renowned American investor Naval Ravikant picked up the baton, suggesting activities such as entrepreneurship, creating books/podcasts/videos, developing software products, going on multiple first dates, attending social parties, reading classic literature, moving to a big city, investing in Bitcoin, and starting Twitter(X).

Some of these examples might resonate differently with you due to cultural differences or simply because they’re a few years old. Overall, I find them largely accurate, though it also made me ponder which opportunities I might be overlooking.

Intrigued by this concept, I started searching for related articles and came across some interesting ones. Here are a few additional examples I’d like to share:

1. Giving Gifts: When you give someone a gift, what you lose is the cost of the gift. However, in return, you can strengthen your relationship with that person, and well-established relationships can be incredibly beneficial in the long run.

2. Meeting New People: The potential losses here are minimal—perhaps a bit of time and money spent on outings. But you might meet someone who has a significant positive impact on your life. The potential gains far outweigh the minor losses. Personally, I enjoy this activity.

3. Writing a Blog: Not necessarily limited to blogging, this refers to organizing and sharing your content (whatever that may be) with others. The loss is mostly your time, while the gains include (1) clarifying your thoughts and content, and (2) if you’re lucky, earning some income or building your personal brand.

4. Reading Good Books: Specifically, “Lindy books”—those that have stood the test of time or have the power to shake a reader’s thinking. The loss here is just the time spent reading. (But really, is reading a book truly a loss of time?)

5. Changing Jobs: Staying at one company for a long time versus switching jobs multiple times each have their distinct pros and cons. According to an article I read, changing jobs can significantly increase your market value and expose you to new opportunities, making it an asymmetric opportunity.

6. Investing: When we think of investing, we usually consider stocks, cryptocurrencies, or real estate. However, the article discussed three main types of investments: (1) investing in areas you know well, (2) investing in people, and (3) investing in companies you’re familiar with. Essentially, investing involves allocating your resources (primarily money) based on future value, which broadens the spectrum of what can be considered an investment.

Encountering this concept made me realize the importance of adopting a "why not try it?" attitude. The examples listed above aren't entirely new—they’re things we’re already familiar with but often hesitate to act on due to laziness or fear.

The more hesitant we are, the more essential it becomes to adopt a "give it a shot" mindset. If pursuing a choice doesn’t involve significant losses, why not just go for it? After all, you might not have as much to lose as you think.

What about you? What asymmetric opportunities can you take advantage of right now?

See you next week.